This price does not include the Fair Trade social premium paid to cooperatives and farmers.ĭo you foresee the introduction of credit from a lender like Root Capital affecting market dynamics at all?Īccess to credit always has been a challenge for coffee cooperatives in the Gayo Highlands region of Aceh in northern Sumatra.

Producers are very aware, especially with the proliferation of cell phones and texting, what the going price is for their coffee, forcing the collectors (including the ones representing Fair Trade cooperatives) to pay the going rate or risk losing out to competing collectors. The collectors sometimes work on behalf of certain exporters but often will pit exporters against each other and see which one is willing to pay the highest price. One of the main differences with the coffee industry in Sumatra is the dominance of “collectors” who buy washed coffee from small-scale producers, since there are very few large producers on the island. This phenomenon happened at the beginning of the 2010-11 harvest and then again during the 2013-14 harvest. As a result, any blips in the supply chain – whether real, projected, or rumored – coupled with high demand can cause the internal market to spike even without a corresponding increase in the international market price (known as the ‘C’ market). specialty market so demand for it is consistently strong, particularly from a few leading specialty roasters who buy large volumes every year. The Sumatra profile has become very popular in the U.S.

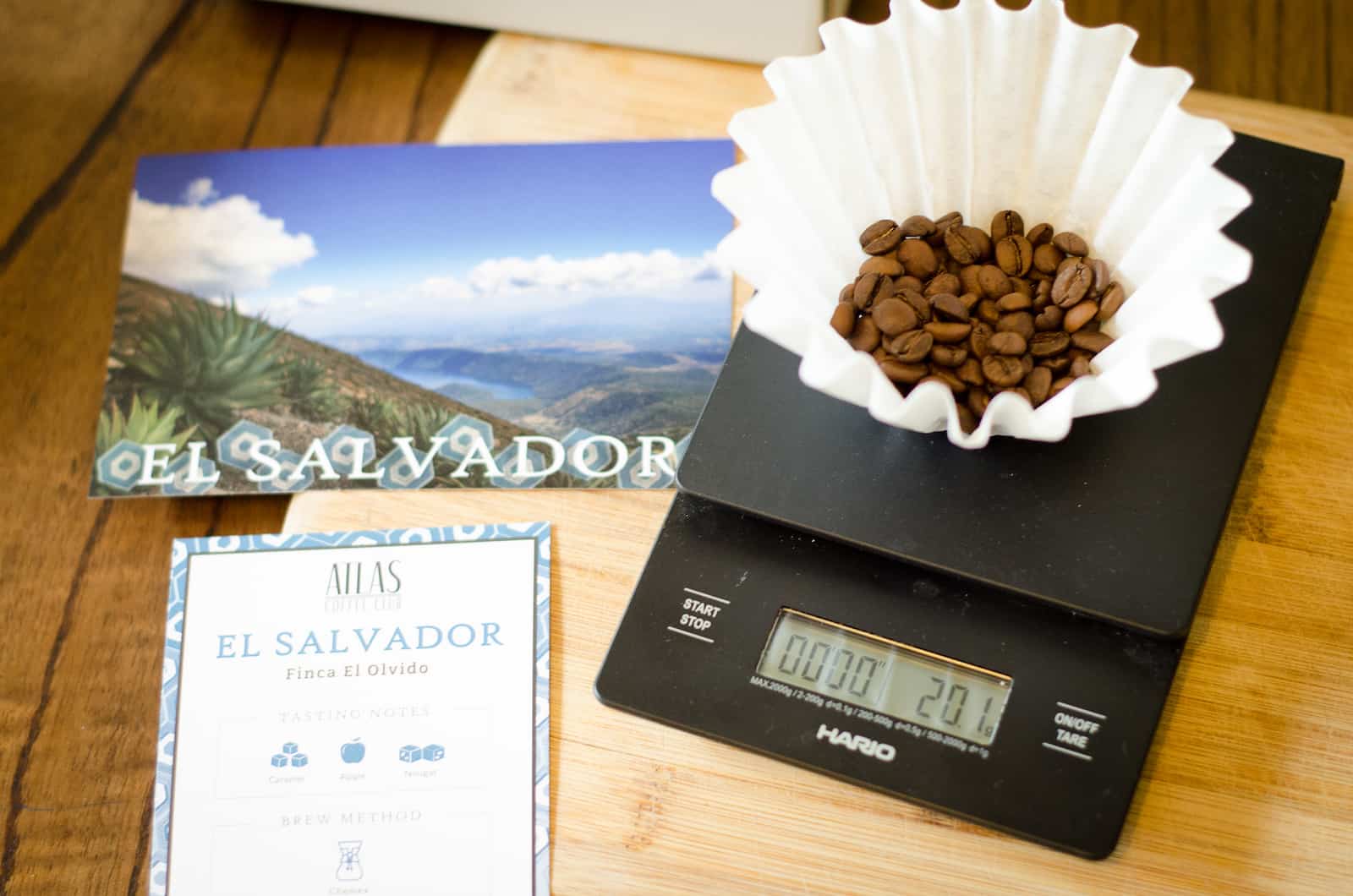

For one thing, the traditional cup profile is so unique that replacing a Sumatra as either a single-origin or a blend component can be challenging, to say the least. The coffee industry in Sumatra is quite different from anything I have seen in the producing world. Can you paint a picture of what the Sumatran coffee industry looks like? How does it compare to others, specifically those in Latin America and Africa? We’ve just recently entered the Indonesia market, making loans to three coffee enterprises in Sumatra. Īl Liu (in green) with collectors at Koperasi Permata Gayo in Bener Meriah, Sumatra.įor the last 15 years, Root Capital has been focused lending to rural businesses in Latin America and Africa. We recently sat down with Al to get a coffee insider’s perspective on the Indonesian coffee market, the country’s smallholder landscape and the significance of Root Capital’s new presence in Sumatra. As a trader and certified coffee specialist for Atlas Coffee Importers, Al has traveled extensively throughout the world’s coffee lands, including those in Indonesia – the latest country added to Root Capital’s growing roster of coffee-growing locales. We are proud to be supported in our work and in our values by our global partners within the Neumann Kaffee Gruppe (NKG).Al Liu, former board director of the Specialty Coffee Association of America (SCAA), is a true coffee connoisseur. In an evolving industry, we also are looking ahead to emerging origins, alternative processes, and the ongoing security of our suppliers. Our profile and standard specialty coffees are cupped rigorously to match target qualities and attributes, allowing our clients the assurance that they will receive a consistent product throughout each crop cycle, and over the years. We also understand the need to maintain a consistent, year-round inventory of workhorse coffees. As a result, we have developed a common purpose and language with some of the most quality-focused producers around the world. Our origin relationships have been built largely through thousands of cupping sessions with producers, millers, and exporters. Our goal is to provide the best possible customer service while importing coffees from all major producing origins. We think the same attention to detail should be paid at all points in between. Growing and processing coffee requires it.

0 kommentar(er)

0 kommentar(er)